#LLP Annual Filing

Explore tagged Tumblr posts

Text

30-May-24 - LLP Form 11 Annual Return of LLP for FY 23-24

30-May-24 : FC-4 - Annual Return of Foreign Company (Branch / Liaison /Project Office)

✅ Extended of Date for exercise of Option by GTA to pay GST itself from 15 Mar, 2024 to 31st May, 2024

✅31-May-24 Form 24Q, 26Q, 27Q Quarterly statements of TDS for January- March

0 notes

Text

LLP Form 11 due dates

Ensure compliance with LLP regulations by staying informed about LLP Form 11 due dates. Our seamless LLP annual return filing services make the process hassle-free. Stay ahead with our expert assistance, meeting deadlines effortlessly. Optimize your LLP's performance by filing Form 11 on time, ensuring legal compliance and peace of mind. Trust us for reliable LLP compliance solutions, tailored to your needs.

Get in touch with our experts today! Email: [email protected] Mobile: +91 9643203209 Website: https://ebizfiling.com/

0 notes

Text

A complete guide on LLP Annual Filing and Process for LLP E-filing

Returns for a Limited Liability Partnership (LLP) should be filed on a regular basis to ensure compliance and avoid the harsh penalties imposed by the law for non-compliance. When compared to the compliance obligations placed on Private Limited Company, a Limited Liability Partnership has only a few compliances to follow each year. File your LLP annual returns with the professional help of Ebizfiling.

0 notes

Text

Annual filings for Limited Liability Partnership

There are numerous matters to be performed to keep compliance for a Limited Liability Partnership (LLP) and keep away from heavy consequences for non-compliance below the law. For example, the go back filings need to be filed periodically. As in comparison to the compliance necessities positioned at the personal restrained companies, Limited Liability Partnerships have just a few compliance necessities to observe every yr, that's pretty low. However, the fines appear to be pretty high. LLPs is probably charged as much as INR five lakh in consequences for non-compliance, while a Private Limited corporation may handiest be charged INR 1 lakh in consequences for non-compliance.

LLP compliance

Due to the truth that Limited Liability Partnerships are separate prison entities, it's far the duty of the elected companions to keep a right ee-e book of debts and record an annual go back with the Ministry of Corporate Affairs (MCA) according with the law.

Except for restrained legal responsibility partnerships with annual turnover over Rs.forty lakhs and contributions over Rs.25 lakh, auditing in their books of debts isn't required. Hence, an LLP isn't required to get their books of account audited if it fulfils the above-stated condition, so the yearly submitting method may be simplified.

The Statement of Account & Solvency for Limited Liability Partnerships need to be filed inside thirty (30) days from the give up of the economic yr, and the Within sixty (60) days of the give up of the economic yr, the yearly go back need to be filed.

Limited Liability Partnerships are required to keep a economic yr from April 1st to March thirty first, much like companies. Every LLP is needed to put up a Statement of Accounts and Solvency with the aid of using October thirtieth of every economic yr, and its annual go back is due on May thirtieth each yr although the LLP has now no longer finished any enterprise in the course of the modern economic yr. Even if the LLP hasn't began any enterprise, a number of the LLP annual submitting are mandatory.

Solvency and Accounts Statements

As a part of its responsibilities as an LLP Annual Filing, all enrolled LLPs are required to maintain correct books of debts and put up them to the nation in Form eight, which incorporates records concerning the earnings made, different economic records associated with the enterprise, and different economic records associated with the enterprise. As nicely as being attested with the aid of using the signatures of the detailed companions, Form eight ought to additionally be licensed with the aid of using a chartered accountant, a corporation secretary, or a value accountant who's actively concerned within side the enterprise. There is a best of Rs.a hundred in step with day in case you fail to record the announcement of debts and solvency file for the economic yr with the aid of using the said due date. The due date for submitting shape eight each yr is October 30.

Filing of the Annual Return

In order to record annual returns according with the law, the LLPs ought to fill out the prescribed shape-eleven. The shape is taken into consideration to be a precis of the control affairs of the LLP, along with the wide variety of companions in addition to their names. Moreover, the shape eleven need to be filed with the aid of using thirtieth May each yr.

Income Tax Act Filings and Audits

According to the Limited Liability Partnership Act, 2008, Limited Liability Partnerships with a turnover of extra than Rs.forty lakh or a contribution of extra than Rs.25 lakh are required to have their books of account audited with the aid of using practicing chartered accountants. In the case of an LLP required to have his books audited, September thirtieth is the closing date for submitting the tax go back.

Note: With impact from AY 2021-22 (FY 2020-21), the edge restrict for a tax audit has been improved to Rs.five crore if the taxpayer’s coins receipts are restrained to five% of gross receipts or turnover, and if the taxpayer’s coins bills are restrained to five% of mixture bills.

LLPs without a tax audit closing date are due July thirty first for taxes. Limited Liability Partnerships which have engaged in any worldwide transactions with related establishments or have undertaken exact home transactions are required to record Form 3CEB. It ought to be licensed with the aid of using a practicing Chartered Accountant. Limited Liability Partnerships that need to record this shape can achieve this with the aid of using thirtieth November.

The LLP ought to record its profits tax go back in Form ITR5 the use of the digital signature of the detailed partner, which may be performed on line through the profits tax website.

0 notes

Text

LLP Annual Filing Requirements Explained

Learn about the essential filing requirements for Limited Liability Partnerships (LLPs) in this comprehensive guide. This article explains the forms required, deadlines, and key compliance obligations for LLPs, helping you avoid penalties and ensure your business remains compliant. From annual returns and statements of accounts to ROC filing details, this guide covers each step to make your LLP filing process smooth and straightforward. Whether you're a new LLP or an established one, stay updated on the latest requirements to keep your business on track.

0 notes

Text

LLP Annual Return Service - Form-11 Filing

Complete your LLP annual filing effortlessly with Form 11 Declaration with Paper Tax Services. Ensure compliance and focus on growing your business without worries. https://bit.ly/4cvLkRT

#Form 11 Filing Service#Form 11 Declaration#Form 11 for LLP#Form 11 for LLP Filing Service#LLP Annual return form 11#Form 11 LLP Filing#Form 11 LLP Filing Service#LLP Annual Filing Service#LLP Annual Return Filing#LLP Annual Return Filing Service

0 notes

Text

Navigating Annual Compliance: A Guide for Pvt Ltd Companies

Annual compliance is not just a legal requirement; it's a cornerstone of good corporate governance and transparency. For private limited (Pvt Ltd) companies in India, adhering to annual compliance regulations is essential to maintain legal standing, uphold accountability, and ensure smooth operations. In this blog, we'll explore the key aspects of annual compliance for Pvt Ltd companies and why it matters.

Understanding Annual Compliance

Annual compliance for Pvt Ltd companies entails fulfilling various legal and regulatory obligations mandated by the Companies Act and other relevant statutes. These obligations include holding annual general meetings (AGMs), filing financial statements, maintaining statutory registers, and complying with tax laws. These tasks are designed to promote transparency, protect stakeholders' interests, and uphold the integrity of the corporate sector.

The Importance of AGMs

AGMs are pivotal events in the annual compliance calendar for Pvt Ltd companies. During these meetings, shareholders gather to discuss and approve financial statements, appoint auditors, declare dividends, and address any other matters concerning the company's affairs. AGMs serve as a platform for shareholders to exercise their rights, engage with company management, and assess the company's performance and governance practices.

Filing Financial Statements

Filing accurate and timely financial statements with the Registrar of Companies (RoC) is a crucial aspect of annual compliance. These statements, including the balance sheet, profit and loss account, and cash flow statement, provide insights into the company's financial health and performance. Compliance with filing requirements ensures transparency, facilitates investor confidence, and mitigates the risk of regulatory penalties.

Maintaining Statutory Registers

Pvt Ltd companies are required to maintain various statutory registers, including registers of members, directors, and charges. These registers contain vital information about the company's ownership, management structure, and financial obligations. Keeping these registers updated and accurate is essential for regulatory compliance, facilitating due diligence processes, and demonstrating good corporate governance practices.

Tax Compliance Obligations

Annual compliance for Pvt Ltd companies also extends to tax-related obligations. This includes filing annual tax returns, such as income tax returns and Goods and Services Tax (GST) returns, and paying applicable taxes within the prescribed deadlines. Compliance with tax laws is critical to avoid penalties, maintain financial integrity, and uphold the company's reputation.

Conclusion:

Annual compliance is a non-negotiable responsibility for Pvt Ltd companies in India. By fulfilling their legal and regulatory obligations, these companies demonstrate their commitment to transparency, accountability, and sound corporate governance. However, navigating the complexities of annual compliance can be challenging, requiring careful planning, attention to detail, and expertise in regulatory matters. Seeking professional assistance from legal and financial advisors can help Pvt Ltd companies stay on top of their compliance obligations and ensure continued success in the dynamic business landscape.

0 notes

Text

Top LLP Company Compliance in Kolkata

Top LLP Company Compliance in Kolkata: Simplifying Compliance with Filemydoc

Introduction:

In the bustling city of Kolkata, numerous limited liability partnership (LLP) companies thrive and contribute to the region's vibrant business ecosystem. However, with the ever-increasing complexities of legal and regulatory frameworks, ensuring compliance can be a daunting task for business owners. This article aims to shed light on the top LLP company compliance requirements in Kolkata and how Filemydoc, a trusted online platform, simplifies the compliance process.

1. Understanding LLP Company Compliance:

Compliance for LLP companies in Kolkata involves adhering to various legal and regulatory obligations. These obligations ensure that businesses operate ethically, maintain transparency, and meet the standards set by the government and relevant authorities. Key compliance requirements for LLP companies in Kolkata include:

a) Registrar of Companies (RoC) Compliance: LLPs must comply with the filing of annual returns, financial statements, and other statutory documents with the RoC.

b) Tax Compliance: Complying with the Goods and Services Tax (GST), income tax, and other applicable tax regulations is crucial for avoiding penalties and maintaining financial transparency.

c) Employment Compliance: LLPs must adhere to labor laws, employee benefits, provident fund, professional tax, and other employment-related compliances.

2. The Importance of Top LLP Company Compliance in Kolkata:

Maintaining compliance is not just a legal requirement but also crucial for the long-term success and reputation of any LLP company in Kolkata. Here's why top LLP company compliance is essential:

a) Avoiding Legal Consequences: Non-compliance can result in hefty penalties, legal disputes, and even the dissolution of the LLP. Adhering to the regulations ensures the company's sustainability and protects its stakeholders.

b) Building Trust and Credibility: Compliant companies foster trust among customers, investors, and partners. Demonstrating commitment to compliance enhances the company's reputation and credibility in the market.

c) Ensuring Operational Efficiency: Compliance procedures often involve streamlining internal processes, leading to improved operational efficiency and reduced risk of errors.

3. Introducing Filemydoc: Simplifying LLP Company Compliance:

Filemydoc, a leading online platform, offers a comprehensive solution for LLP company compliance in Kolkata. With its user-friendly interface and advanced features, Filemydoc simplifies the compliance process, allowing businesses to focus on their core operations. Key features of Filemydoc include:

a) Automated Compliance Reminders: Filemydoc sends timely notifications and reminders about upcoming compliance deadlines, ensuring companies never miss a crucial filing date.

b) Document Management System: The platform provides a secure and centralized repository to store and manage all compliance-related documents, eliminating the hassle of manual record-keeping.

c) Expert Guidance and Support: Filemydoc offers expert guidance and assistance from professionals well-versed in the complexities of LLP company compliance. Users can seek advice and resolve queries through the platform's support channels.

4. Top LLP Company Compliance Services Offered by Filemydoc:

Filemydoc offers a range of services designed to address the specific compliance needs of LLP companies in Kolkata. Here are some of the top services provided by Filemydoc:

a) Annual Compliance Filings: Filemydoc facilitates seamless filing of annual returns, financial statements, and other statutory documents with the RoC, ensuring companies stay compliant.

b) Tax Compliance: The platform assists in GST registration, filing GST returns, income tax return filing, and other tax-related compliances, helping companies meet their tax obligations accurately and efficiently.

c) Legal and Regulatory Support: Filemydoc provides expert advice and assistance on legal and regulatory matters, including company incorporation, changes in partnership agreements, and compliance audits.

d) Compliance Audit and Due Diligence: The platform offers comprehensive compliance audits to identify areas of improvement and ensure adherence to all relevant regulations. This service is particularly useful during mergers, acquisitions, or partnership restructuring.

e) Annual Maintenance Packages: Filemydoc offers customized annual maintenance packages that cover all major compliance requirements, enabling companies to outsource their compliance management and focus on their business growth.

Conclusion:

Maintaining compliance with the legal and regulatory requirements is paramount for LLP companies in Kolkata. With the complexities involved, partnering with a reliable online platform like Filemydoc can simplify the compliance process significantly. By leveraging Filemydoc intuitive interface, automated reminders, and expert support, businesses can ensure seamless compliance management, avoid penalties, and build a strong reputation. Embrace Filemydoc to streamline your LLP company compliance in Kolkata and stay ahead in the dynamic business landscape

#LLP Annual Return Filing#LLP Registration in India#Limited Liability Partnership (LLP) Registration in India

0 notes

Text

Process of closing an LLP in India

The Limited Liability Partnership (LLP) is a trendy type of business entity, established in 2008 by the Limited Liability Partnership Act, that integrates the features of a company and a partnership. In earlier articles, we discussed the documents mandated for LLP registration and the registration process itself.

This article aims to assist you with the procedure for closing an LLP in India.

Although LLPs offer several benefits over other kinds of business entities, such as ease of incorporation and limited liability for members, these advantages do not necessarily translate into flourishing business operations. This article will explain the Strike Off method of closure and provide an overview of other closure options.

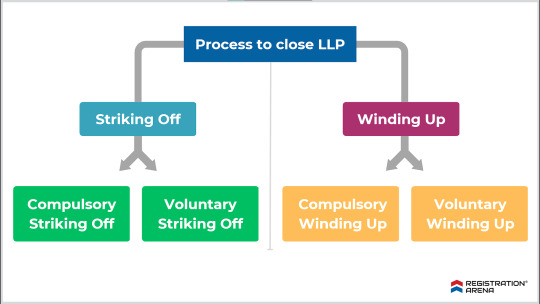

The process to close a Limited Liability Partnership

An LLP can be closed in two ways:

1. Strike-off method-

a. Voluntary Strike Off

The LLP should not have been engaged in commercial activities for a period of at least one year.

The LLP must file an application in Form 24 LLP with the Registrar of LLPs to apply for voluntary strike-off status.

The LLP should have completed all compliance requirements by the date of filing for closure. However, it is only required to file annual returns until the end of the year when commercial activities are discontinued.

The LLP must have obtained the approval of all parties involved, including members, creditors, and any regulatory authorities under whose domain the LLP works.

The LLP should not have any assets or liabilities as of the date of preparation of financial statements.

The process to close LLP through Strike Off method

In order to move forward with the Strike Off process, the LLP must follow the steps outlined below:

The LLP must plan a meeting of all partners to pass a resolution to strike off the name.

The LLP must pay all outstanding debts and liabilities before proceeding with the Strike Off process.

The meeting of partners must permit a designated partner to file the application for Strike Off.

The designated partner must file an application in e-Form 24 and submit it to the Registrar. The application must have the approval of all members.

Read more to know about the Procedure of Closing LLP in India

#closure of llp#llp registration#private limited company registration#opc registration#nidhi company registration#startup registration#trademark registration#annual compliance of llp#annual compliance of private limited company#itr filing#tds return filing#legal services#legal consultation

0 notes

Text

Back in 2022 at the annual Code Conference, where tech luminaries submit to onstage interviews, an audience member asked Apple CEO Tim Cook for some tech support. “I can’t send my mom certain videos,” he said; she used an Android device, which means she can't access Apple’s iMessage. Cook’s now-infamous response: “Buy your mom an iPhone.”

Cook’s remark and Apple’s recent decision to block the third-party app Beeper from bridging the Android-to-iMessage interoperability chasm are two of the many examples of allegedly monopolistic behavior cited in the US government’s antitrust suit against Apple. Central to the case is Apple’s practice of “locking in” iPhone customers by undermining competing apps, using its proprietary messaging protocol as glue, and generally making it challenging for people to switch to other phones.

Those accusations are backed up by lawyerly references to the Sherman Act. But the complaint also shows the Department of Justice crafting a cultural narrative, trying to tell a technology tale with a clear message—like an episode of the crime drama Dragnet, says antitrust expert William Kovacic, who teaches at George Washington University and King’s College, London.

The Apple antitrust lawsuit, filed Thursday by the DOJ and more than a dozen state attorneys general, claims that in addition to degrading the quality of third-party apps, Apple “affirmatively undermines the quality of rival smartphones.” Because messages sent between iPhones via Apple’s proprietary network appear in blue bubbles, but those from Android phones appear in green and are excluded from many iMessage features, Apple has signaled to consumers that rival phones are of less quality, the suit alleges.

The suit includes references to the negative cultural and emotional impact of the restrictiveness of some Apple products. It ranges beyond the typical antitrust case, in which investigators might focus on supracompetitive pricing or the conditions of corporate deals that restrict competition. The core of US antitrust cases has long been proving consumers paid higher prices as a result of anticompetitive practices. But a few key paragraphs within the 88-page filing mention the exclusion and social shaming of non-iPhone users confined inside green chat bubbles, distinguishing this case from some of the more recondite explanations of tech market competition in recent years.

“Many non-iPhone users also experience social stigma, exclusion, and blame for ‘breaking’ chats where other participants use iPhones,” the suit reads. It goes on to note that this is particularly powerful for certain demographics, like teenagers, who The Wall Street Journal reported two years ago “dread the ostracism” that comes with having an Android phone.

The DOJ argues that all of this reinforces the switching costs that Apple has baked into its phones. Apple is so dominant in the smartphone market not because its phones are necessarily better, the suit alleges, but because it has made communicating on other smartphones worse, thereby making it harder for consumers to give up their iPhones.

Legal experts say this social stigma argument will need much stronger support to hold up in court, because it doesn’t fit with traditional definitions of antitrust. “What is Apple actually precluding here? It’s almost like a coolness factor when a company successfully creates a network effect for itself, and I’ve never seen that integrated into an antitrust claim before,” says Paul Swanson, a litigation partner at Holland & Hart LLP in Denver, Colorado, who focuses on technology and antitrust. “This is going to be an interesting case for antitrust law.”

Regardless, the DOJ’s complaint builds a powerful message from the cacophony of consumer voices that have vented frustrations with iMessage’s lack of interoperability in recent years. And it’s part of a broader, democratizing theme introduced by Jonathan Kanter, the assistant attorney general for the DOJ’s Antitrust Division, says Kovacic, who previously served as chair of the Federal Trade Commission. “Kanter basically said, ‘We’re trying to make this body of law accessible to ordinary human beings and take it away from the technicians,’” Kovacic says. “Storytelling is overstated in some ways, but my sense is that a lot of work went into this filing.”

Apple has rejected the DOJ’s allegations. In an earlier statement to WIRED, Apple spokesperson Fred Sainz said that the lawsuit “threatens who we are and the principles that set Apple products apart in fiercely competitive markets” and added that its products work “seamlessly” together and “protect people’s privacy and security.”

Cultural arguments about the harms of the iPhone’s stickiness will resonate with a lot of consumers, even if they end up being legally indefensible. Blue bubble vs. green bubble messaging has become a much more mainstream debate that transcends the wonky, technical underpinnings of iMessage’s protocol. Apple has also consistently boasted of iPhone and iMessage’s tight security, while seemingly denying third-party apps—such as Beeper—the ability to offer a similar level of security between iPhones and Android phones.

Apple has suggested that the design of iMessage is not anticompetitive, because iPhone users can install and use any third-party messaging app they please, as long as it’s available in the App Store. Apps like Facebook Messenger, WhatsApp, and Signal can all be installed on iPhones and give messages sent from users on Android or iPhone equal treatment.

The DOJ takes aim at that, too, saying that these other apps first require opt-in from consumers on both sides of a conversation because they form closed systems of their own. And the case points out that Apple hasn’t given app developers any technical means of accessing the iPhone messaging APIs that would allow SMS-like, cross-platform, “text to anyone” functions from those apps.

Swanson says he still believes Apple has been careful to take the necessary steps to legally preserve consumer choice, which is one of the fundamental principles in US antitrust law. “You probably can’t do sophisticated messaging on a T9 phone these days,” he says, referencing the predictive text system that dominated before the iPhone popularized touchscreens. “But there are plenty of other options in the market that won’t deprive you of a network effect.”

Kovacic believes that as the case continues, the DOJ will have to bring forward new evidence and arguments to stand up the cultural aspects of its suit. That could involve tapping theories of economics and the psychology of human behavior to attempt to explain why some technology consumers may unconsciously favor certain products they are emotionally attached to. More likely, he says, the DOJ will have to present contemporaneous business notes that show Apple’s anxiety about competitive apps or emerging technologies, and how the company responded in apparently dubious ways.

One way the DOJ tries to stand up its allegations is by comparing Apple to an earlier antitrust target: Microsoft. In a historic antitrust case filed in 1998, the DOJ presented evidence that Bill Gates’ company was fearful that software like the Netscape browser could weaken the market power of Windows, Kovacic says.

Steven Sinofsky, a former longtime Microsoft executive, wrote in a highly charged blog post on Saturday that he suspects many of the suit’s arguments about Apple’s products will prove to be irrelevant. “Almost all of the [DOJ-Apple] battles will end up being about the terms and conditions of contracts which is the stuff lawyers and courts are good at, and not on product design,” he wrote. “The vast majority of the settlement in the Microsoft case ended up being terms and conditions licensing Windows.”

In other words, the DOJ has shown some of its cards in this initial complaint—and told a story that will resonate with many frustrated smartphone users. But to keep the case alive the agency will have to present additional, concrete, evidence that Apple’s anxieties about its products being devalued led it to act in ways that caused actual harm. If the DOJ wants to make the case against Apple as historic as the one against Microsoft it will have to prove, as Kovacic puts it, “that the anecdotes aren’t just storytelling.”

7 notes

·

View notes

Text

Setting Up a Business in India: A Comprehensive Guide by Masllp

India has become a preferred destination for both local and international entrepreneurs, thanks to its growing economy, favorable government initiatives, and emerging consumer market. Whether you're a small startup or an established company looking to expand, setting up a business in India can offer remarkable opportunities. Masllp, a trusted consulting partner, specializes in helping businesses navigate the complex procedures of registration, compliance, and scaling in India.

Why Set Up a Business in India? India’s business landscape is evolving rapidly, making it an attractive destination for a wide range of industries. Here are a few key reasons to consider setting up a business in India:

Growing Consumer Market: With a large and young population, India offers a vast market for consumer goods, services, and technology. Ease of Doing Business: Government initiatives like Make in India and Startup India have simplified regulatory processes, reduced barriers, and encouraged foreign investment. Supportive Economic Policies: India's government has introduced tax incentives and simplified tax structures that foster a business-friendly environment. Skilled Workforce: India is home to a skilled and diverse workforce, making it easier to find qualified employees in virtually any industry. Steps to Setting Up a Business in India with Masllp Masllp offers end-to-end support in setting up a business in India, from choosing the right business structure to managing compliance. Here’s a step-by-step guide:

Choosing the Right Business Structure India offers several business structures, including Private Limited Company, Limited Liability Partnership (LLP), and Sole Proprietorship. Each has its advantages and requirements:

Private Limited Company: Ideal for businesses seeking to raise funds or expand quickly. LLP: Offers flexibility with limited liability and is easier to manage. Sole Proprietorship: Suitable for small businesses looking to test the market before expanding. Masllp assists clients in selecting a structure that aligns with their business objectives, ensuring compliance with local laws and regulations.

Registration and Legal Formalities Once the business structure is chosen, Masllp handles the complete registration process, including obtaining a Director Identification Number (DIN), Digital Signature Certificate (DSC), and Certificate of Incorporation. These are crucial for:

Establishing the company’s legal identity in India. Allowing the business to operate under its registered name. Providing a smooth setup process without regulatory hiccups.

Securing Necessary Licenses and Permits Depending on the nature of the business, specific licenses and permits might be required. Industries like food, pharmaceuticals, and manufacturing often need approvals from regulatory bodies. Masllp guides businesses through this process, ensuring that all permits are acquired for seamless operation.

Setting Up Bank Accounts and Financial Structuring Setting up a local bank account is essential for conducting business in India. Additionally, understanding India's taxation system is crucial for compliance. Masllp assists in setting up business bank accounts, as well as in understanding the Goods and Services Tax (GST), Income Tax, and other fiscal regulations, ensuring compliance and optimizing tax efficiency.

Hiring and Staffing Solutions India offers a large talent pool across diverse industries. Masllp provides HR solutions, including assistance with recruitment, payroll management, and employee benefits, to help businesses find the right team and establish efficient HR practices.

Ongoing Compliance and Reporting India has specific reporting and compliance requirements, such as annual returns, GST filings, and income tax submissions. Masllp offers ongoing compliance management, ensuring that businesses meet regulatory deadlines and avoid penalties.

Benefits of Partnering with Masllp When setting up a business in India, having an experienced partner like Masllp can streamline processes, reduce delays, and enhance operational efficiency. Masllp’s services include:

Expert Guidance: With in-depth knowledge of India’s business laws and market trends, Masllp offers strategic insights for a successful setup. Personalized Solutions: Each business is unique, and Masllp provides customized solutions to meet specific requirements. End-to-End Support: From registration to compliance, Masllp offers comprehensive support throughout the business setup journey. Common Challenges in Setting Up a Business in India While India’s business landscape is promising, challenges such as regulatory compliance, tax structures, and complex documentation can arise. Masllp has a deep understanding of these potential obstacles and employs a proactive approach to address them, ensuring smooth business initiation and growth.

Start Your Business Journey with Masllp Today! Setting up a business in India can be a transformative decision for entrepreneurs and companies alike. With Masllp by your side, you’ll have a trusted partner who understands the intricacies of the Indian market and regulatory environment. From initial planning to full-scale operations, Masllp ensures a smooth, compliant, and successful business setup experience in India.

#accounting & bookkeeping services in india#audit#businessregistration#foreign companies registration in india#chartered accountant#income tax#auditor#taxation#ap management services

6 notes

·

View notes

Text

Company Incorporation Consultants in Delhi by SC Bhagat & Co.

Starting a new business in Delhi can be a rewarding venture, but it also comes with its own set of legal and administrative challenges. One of the critical steps in building your business is the incorporation process, which requires careful attention to various regulations. This is where professional assistance from SC Bhagat & Co., a leading company incorporation consultant in Delhi, becomes invaluable.

Why Choose Professional Company Incorporation Consultants? Incorporating a company involves several legal procedures, such as:

Selecting the correct business structure Filing the necessary paperwork with regulatory authorities Complying with tax laws Obtaining approvals and licenses The process can be complex and time-consuming for new entrepreneurs. SC Bhagat & Co. helps streamline this procedure, ensuring compliance with all legal requirements while minimizing delays.

Services Offered by SC Bhagat & Co. As one of the top company incorporation consultants in Delhi, SC Bhagat & Co. offers a range of services that cater to startups, small businesses, and large corporations. These include:

Business Structure Advisory Choosing the right business structure is crucial for long-term success. The firm provides guidance on various business entities, including:

Private Limited Company Limited Liability Partnership (LLP) One Person Company (OPC) Public Limited Company SC Bhagat & Co. ensures that you opt for the structure best suited to your business goals and tax advantages.

Registration Services From company name reservation to filing of incorporation documents, SC Bhagat & Co. handles the entire registration process. They assist with:

Drafting Memorandum and Articles of Association (MOA/AOA) Digital signature certificates (DSC) Director Identification Number (DIN) Filing with the Ministry of Corporate Affairs (MCA) Their comprehensive approach makes the process seamless and efficient.

Compliance and Taxation Support Once incorporated, companies are required to meet various compliance standards, including:

GST registration and filing Annual financial statements Regulatory audits SC Bhagat & Co. offers ongoing support to ensure your business stays compliant with both state and central laws, thus avoiding penalties and legal hurdles.

Legal Advisory and Licensing Navigating the legal landscape in India can be tricky. SC Bhagat & Co. also provides assistance in obtaining the necessary business licenses and permissions, such as:

Trade license Import-export code (IEC) Professional tax registration Why SC Bhagat & Co. Stands Out With years of experience in the field, SC Bhagat & Co. has become synonymous with trust and expertise in company incorporation consulting in Delhi. Here’s why they stand out:

Expert Team: Their team consists of highly qualified professionals, including chartered accountants and legal experts. Personalized Service: They tailor their services according to the specific needs of your business. Quick Turnaround: Their efficient processes ensure timely incorporation and compliance. Post-Incorporation Support: Even after your company is set up, SC Bhagat & Co. provides continuous support for your legal and financial needs. Conclusion Incorporating a company is a significant step in the journey of entrepreneurship. With the expert guidance of SC Bhagat & Co., you can rest assured that all legal and regulatory requirements will be handled efficiently, allowing you to focus on growing your business. If you're looking for reliable company incorporation consultants in Delhi, SC Bhagat & Co. should be your first choice.

#gst#taxation#accounting firm in delhi#accounting services#direct tax consultancy services in delhi#tax consultancy services in delhi#taxationservices

2 notes

·

View notes

Text

Limited Liability Partnership (LLP) ROC Compliance

Limited Liability Partnership (LLP) ROC Compliance refers to the regulatory requirements that LLPs need to fulfill with the Registrar of Companies (ROC). In various jurisdictions, including India, LLPs are mandated to adhere to specific compliance norms set by the ROC to ensure transparency, legal conformity, and proper governance. These compliances typically include the timely filing of annual returns, financial statements, and other essential documents. Meeting LLP ROC Compliance is crucial for maintaining good standing with regulatory authorities and avoiding penalties. It underscores the commitment of LLPs to operate within the legal framework and uphold accountability in their business practices.

0 notes

Text

Unveiling Limited Liability Partnership Registration: A Step-by-Step Guide

In the realm of business structures, Limited Liability Partnerships (LLPs) have emerged as a favored choice for entrepreneurs seeking a balance between liability protection and operational flexibility. Offering the advantages of both traditional partnerships and limited liability companies, LLPs provide a unique framework that appeals to a wide array of professionals and businesses. If you're considering forming an LLP, navigating through the registration process can seem daunting. However, fear not! In this comprehensive guide, we'll break down the intricacies of LLP registration, simplifying each step to set you on the path to success.

Understanding Limited Liability Partnerships

Before delving into the registration process, let's grasp the essence of Limited Liability Partnerships. An LLP combines features of both partnerships and corporations, providing its partners with limited personal liability akin to shareholders in a corporation. This implies that partners are not personally liable for the debts and obligations of the business beyond their investment. This protective shield for personal assets makes LLPs an attractive option for professionals such as lawyers, accountants, consultants, and small businesses.

Step-by-Step Guide to LLP Registration

1. Choose a Name

Ensure that your chosen name complies with the regulations stipulated by the relevant authority. It should not infringe on existing trademarks and should reflect the nature of your business.

2. Obtain Digital Signature Certificates (DSC)

LLP registration necessitates the use of Digital Signature Certificates (DSC) for filing various documents electronically. Obtain DSCs for all partners involved in the LLP.

3. Obtain Designated Partner Identification Number (DPIN)

This unique identification number is mandatory for all individuals intending to be appointed as partners.

4. Drafting LLP Agreement

The LLP agreement outlines the rights and duties of partners, profit-sharing ratios, decision-making procedures, and other pertinent details. Draft a comprehensive LLP agreement in accordance with the provisions of the LLP Act.

5. File Incorporation Documents

Compile and file the necessary incorporation documents with the Registrar of Companies (ROC). These documents typically include Form 1 (Incorporation Document) and Form 2 (Details of LLP Agreement). Pay the requisite fees along with the submission.

6. Registrar Approval and Certificate of Incorporation

Upon submission of documents, the Registrar will scrutinize the application. If all requirements are met satisfactorily, the Registrar will issue a Certificate of Incorporation, officially recognizing the LLP's existence.

7. Obtain PAN and TAN

After obtaining the Certificate of Incorporation, apply for Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) for the LLP.

8. Compliance with Regulatory Requirements

Ensure compliance with all regulatory requirements post-incorporation. This includes maintaining proper accounting records, filing annual returns, and adhering to tax obligations.

2 notes

·

View notes

Text

Steps for Annual LLP Filing & Compliance

Limited Liability Partnerships (LLPs) are a popular form of business structure that combines the advantages of a partnership and a limited company. Annual Filing for LLP in India is required to comply with various legal obligations, including annual filings, which are crucial for maintaining their active status and avoiding penalties. This article provides a detailed overview of the annual filing requirements for LLPs, the deadlines, and the penalties associated with non-compliance.

Essential Annual Filing Requirements for LLP

Annual Return (Form 11) Every LLP is required to file an Annual Return in Form 11 with the Registrar of Companies (ROC) within 60 days from the end of the financial year. This means that filing is typically due by May 30th each year. Form 11 contains details of the LLP's partners and any changes that occurred during the year.

What to include in Form 11?

Total number of partners

Contributions received by partners

Any change in the composition of partners

Summary of obligations and compliance during the year

Penalty for non-filing: If Form 11 is not filed within the due date, a penalty of Rs. 100 per day is imposed until compliance is achieved, without any maximum limit.

Statement of Account & Solvency (Form 8) LLPs must file their Statement of Account and Solvency in Form 8 every year, completed by October 30th of each financial year. Form 8 includes details about the LLP's financial position, including the declaration of solvency by the designated partners.

What to include in Form 8?

Statement of solvency or insolvency

Profit and loss statement

Balance sheet

Details of contingent liabilities, if any

Penalty for non-filing: A daily fine of Rs. 100 is imposed for delayed filing without any upper limit.

Income Tax Return (ITR) Every LLP must file an Income Tax Return by July 31st of the assessment year if audit requirements do not apply. However, if the LLP's accounts are subject to audit, the deadline is extended to September 30th.

What to include in the ITR?

Total income and deductions

Profit-sharing ratios among partners

Tax liabilities and payments

Any audits conducted during the year (if applicable)

Penalty for non-filing: If the ITR is not filed within the due date, a late filing fee of Rs. 5,000 is applicable. However, for LLPs with a total income of less than Rs. 5 lakhs, the late fee is reduced to Rs. 1,000. Interest on the late filing of taxes and penalties may also apply.

Additional Compliances

Audit Requirement: LLPs with an annual turnover of more than Rs. 40 lakhs or contributions exceeding Rs. 25 lakhs are required to get their accounts audited by a Chartered Accountant.

Maintenance of Books of Accounts: LLPs are required to maintain proper books of accounts on a cash or accrual basis, following double-entry accounting systems. The records should be kept for at least eight years.

Consequences of Non-Compliance

Non-compliance with annual filing requirements can result in:

Heavy penalties: Continuous daily penalties until the required forms are filed.

Loss of LLP status: In extreme cases, prolonged non-compliance can result in the Registrar declaring the LLP defunct.

Disqualification of partners: If an LLP fails to comply with its annual filings for an extended period, its designated partners may face disqualification from holding similar positions in other LLPs or companies.

Conclusion

Annual Filing for LLP proper functioning. It helps maintain the business's legal status, ensures transparency, and keeps the LLP compliant with regulatory obligations. Designated partners should be vigilant about deadlines to avoid penalties and legal issues. With proper planning and timely submissions, LLPs can ensure smooth operations and adherence to all statutory requirements.

0 notes

Text

1 note

·

View note